top of page

FUNDING

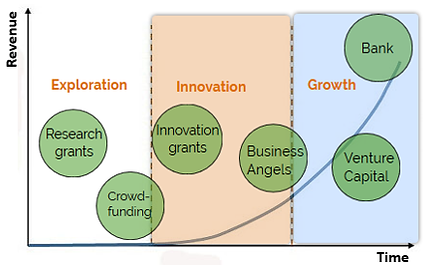

For a new venture, funding options differ in each of 3 typical development stages:

1. Exploration stage is a “pre-seed”/“seed” phase where the company needs to back financially its first research investments. Typical funding: Research grants and Crowdfunding

2. Innovation stage is an “early stage” phase where the company prepares its innovation to the market and to execute a business take-off. Typical funding: Innovation grants and Business angels.

3. Growth stage is a “scale-up” phase where the company wants to exploit any opportunity to grow and expand quickly. Typical funding: Venture Capital and Banks.

We guide companies to select appropriate funding strategies and we prepare convincing documents.

After a deep analysis of the case, we build-up a comprehensive business plan (innovation potential, market analysis, development strategy, industrial capabilities, financial forecasts, risk mitigations...) that can be a cornerstone in grant applications, investment pitches or bank loan requests.

When required, we coach our clients to better defend the case (in documents and in presentations).

We provide a large support on Public Funding (EU grants) and on Private Funding (equity and debt):

EUROPEAN GRANTS

EQUITY & DEBT

bottom of page